Kansas City Southern reports strong first quarter results

Written by David C. Lester, Editor-in-Chief

Kansas City Southern reported record revenues of $731.7 million, an increase of 8% from first quarter 2019. Overall, carload volumes were up 4% compared to prior year.

First Quarter 2020

First quarter revenues were $731.7 million, an increase of 8% primarily led by a 18% increase in Chemicals and Petroleum due primarily to increased refined fuel products and liquid petroleum gas shipments to Mexico. Intermodal revenues grew 11%, driven primarily by strong cross-border shipments. Agriculture and Minerals and Industrial and Consumer Products revenues also increased by 9% and 6%, respectively. These increases were partially offset by revenue declines in the remaining two commodity groups. Energy revenues declined by 13%, as increased Crude Oil shipments were more than offset by declines in Utility Coal and Frac Sand; Automotive revenues declined by 6%.

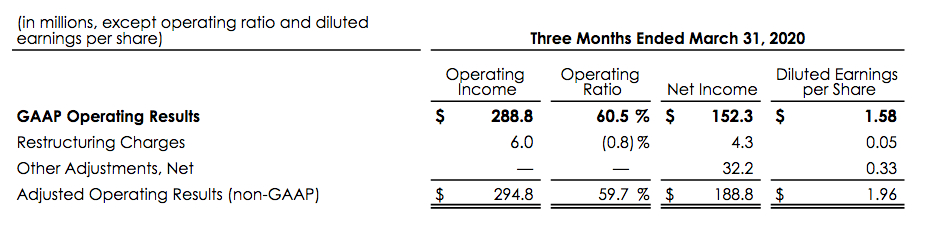

First quarter operating expenses were $442.9 million, including $6.0 million of restructuring charges related to PSR initiatives. Operating income was $288.8 million and the reported operating ratio was 60.5%; on an adjusted basis, operating ratio was 59.7%. First quarter net income was $152.3 million, or $1.58 per diluted share. Adjusted first quarter operating income, operating ratio, net income and diluted earnings per share were as follows:

Due to the general economic uncertainty created by the global COVID-19 pandemic, KCS is withdrawing previously provided revenue, volume, operating ratio and earnings per share guidance. Previously provided capital expenditure guidance is revised from ~17% of revenue to ~$450.0 million. Guidance for 2021 and 2022 capital expenditures remains at ~17% of revenue. The Company is targeting $500.0 million or more of free cash flow in 2020. See the following pages for a reconciliation of historical free cash flow.

“KCS posted a record first quarter, driven by 8% revenue growth and judicious expense management,” stated President and Chief Executive Officer, Patrick J. Ottensmeyer. “This outstanding performance resulted in arecord adjusted operating ratio of 59.7%, which reflects the positive impact of PSR-related efficiencies and cost controls.

“As pleased as we are with this exceptional performance, we have now turned our full attention to the rapidly changing operating and economic environment. The COVID-19 pandemic presents KCS and companies across the globe with unprecedented challenges and uncertainty. We are responding by prioritizing the safety of our employees and ensuring business continuity. At the same time, we are focusing intently on rightsizing our resources in the face of declining volumes, while remaining prepared for a return to volume growth.

“KCS is well-prepared to handle this period of challenge and uncertainty. Our employees are dedicated, vigilant and focused. Moreover, our financial profile has never been stronger with ample liquidity and a favorable debt maturity schedule. I am confident that the actions we are taking to accelerate our already successful PSR implementation during this downturn will further strengthen the Company and leave us well-positioned to handle future volume growth.”

A Kansas City Southern news release.

For the latest railroad news, please visit rtands.com.

Canadian Pacific Q1 2020 financial results

Union Pacific Q1 2020 financial results

Canadian National Q1 2020 financial results

Norfolk Southern Q1 2020 financial results