CPKC’s Coby Bullard Headlines Railway Interchange

Written by Marybeth Luczak, Executive Editor, Railway Age

Railway Interchange kicked off Oct. 2 with Canadian Pacific Kansas City (CPKC) Senior Vice President Coby Bullard covering his railroad’s April 14, 2023, merger to form North America’s first and only transnational, plus its partnership with short lines and its hydrogen locomotive program. The opening session in Indianapolis was hosted by AREMA, RSI, RSSI and REMSA and sponsored by FreightCar America.

As CPKC nears its six-month anniversary, work is under way to build the new company, which combined Canadian Pacific (CP) and Kansas City Southern (KCS), as well as its culture, said Bullard, who joined CP in 2017 and now heads up CPKC Sales and Marketing-Merchandise, ECP, Transload and Business Development. “It’s not easy work,” he said, “but it’s fun. It’s exciting.”

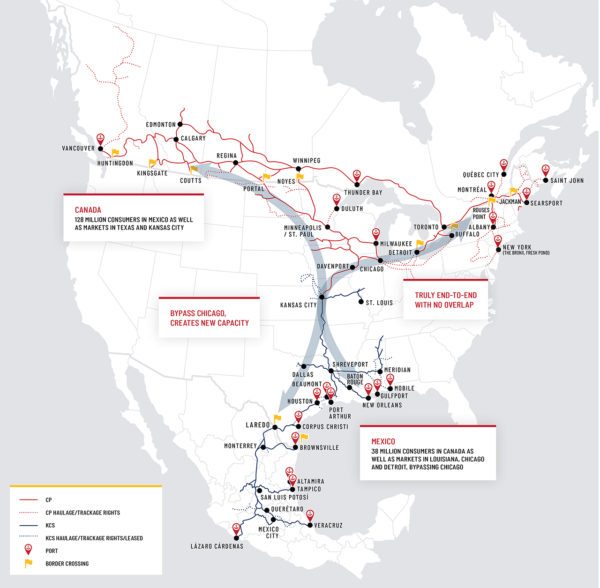

Historically, railroading has been about east-west connections of population and production centers, Bullard told attendees. CPKC is now filling the need for a north-south connector, a single linehaul solution for the U.S., Canada and Mexico. Owning the track all the way through not only “unlocks investment,” he said, but also provides “better products and services for customers in all three countries so they can continue to grow their business.”

CP about five years ago held an executive retreat to address “big ideas” for future growth, according to Bullard, and one of those ideas became a “driver” of its merger with KCS: Nearshoring, the relocating of manufacturers from Asia—mostly China—to North America—mostly Mexico.

Bullard outlined the following CPKC “value propositions” and growth areas during his presentation:

• CPKC is seeing growth in all markets—across construction and building products, steel and aluminum in the automotive space, and automotive manufacturing, for example. The customers listed on and the locations mapped on Bullard’s presentation slide below represent a total of nearly $20 billion in industrial development projects that have broken ground and will be coming on line in the next 24-48 months. This is all carload business, Bullard said, and does not include the approximately $10 billion Tesla is spending in Monterrey, Mexico, to build an automotive manufacturing facility on the CPKC line, and the $15 billion being invested in that region for Tesla suppliers.

• Customers are investing in North American supply chain solutions that leverage CPKC rail service. Bullard offered the example of Aluminum Dynamics, a new subsidiary of Fort Wayne, Ind.-based Steel Dynamics. To get into the aluminum market, Steel Dynamics wanted to build an end-to-end supply chain, he explained. The company will use CPKC to haul aluminum ingots from eastern Canada to new slab-production facilities in Arizona and Monterrey; to carry the slabs to a rolling facility in Mississippi; and to send the rolled aluminum to the packaging and automotive industries in Detroit, the southeastern U.S., and Mexico. Steel Dynamics is spending $4 billion on the Arizona, Monterrey and Mississippi facilities for the project, Bullard said. The Arizona and Monterrey facilities are expected to ship 1,750 carloads per year to Mississippi.

• The CPKC network has 6,000 acres of land available for development. “This gives us the ability to go out to our customers or partners and say, ‘How can we leverage this land to become more efficient in our rail operations? How can we leverage this land to co-locate with a customer and bring somebody that wants to build a new facility onto our railroad?’” Bullard said. CPKC and Americold in June teamed on a cold-storage facility co-location initiative.

• As part of CPKC’s roughly $3 billion capital plan for 2023, Bullard told attendees that it is focusing on three core projects: installing by year-end 2024 a second international rail bridge at the U.S./Mexico border that will connect the cities of Laredo, Tex., and Nuevo Laredo, Mexico, and “double-plus” capacity (through an approximately US$100 million investment); expanding by year-end 2026 its Bensenville Yard in Chicago (through an approximately US$300 million investment); and building or expanding 26 sidings at the mid-point of its network (through an approximately US$275 million investment).

• CPKC in May introduced daily intermodal service between the Midwest and Mexico with trains MMX-180 and MMX-181, linking Chicago, Kansas City, Texas markets, Monterrey and San Luis Potosi. “Our CPKC transit time from cut-off to release is 3.9 days,” Bullard said. “A single-driver truck averages four days. Our stated goal is five days, so we’re beating that by a full day. Our goal is to convert 75,000 to 100,000 trucks off the road.”

During the Q&A portion of his presentation, Bullard highlighted CPKC’s partnership with short lines and its hydrogen locomotive program, which CP began in December 2020 with the retrofit of an existing diesel-electric linehaul locomotive.

“I can’t stress enough how important short lines are to our business,” Bullard said, noting that 65% of CP’s growth in carload business included short lines at origination or destination. “The high-touch service that short lines provide to customers and the ability for them to work on creative solutions to help customers, help us, and help [themselves] grow is a win-win-win,” he said. CPKC has invested in and added to its short line team to provide support.

“The time for hydrogen locomotives is now,” Bullard told attendees at the Railway Interchange session’s conclusion. CPKC currently has two low-horsepower units: a four-axle and a six-axle that are being tested in Calgary. This month it will have ready for testing a high-horsepower six-axle unit, he reported.

In June, CPKC signed an agreement with CSX to develop additional hydrogen-powered locomotives, and Bullard told attendees that the Jacksonville, Fla.-based Class I “will bring on 20-plus units, 25 units, and CPKC is also going to ramp up production at roughly the same rate, so expect to see hydrogen locomotives expand and expand quickly.”

Bullard pointed out that while the use of hydrogen is the most environmentally friendly solution for locomotive power, “right now it does not make economic sense, but we’ll continue to work to get the economics where they need to be.”

For more on CPKC, listen to Railway Age Editor-in-Chief William C. Vantuono’s Rail Group on Air podcast with John Orr, Executive Vice President and Chief Transformation Officer.