Kansas City Southern reports Q4 and 2020 full-year results

Written by David C. Lester, Editor-in-Chief

Kansas City Southern (KCS) (NYSE:KSU) reported strong fourth quarter and full year 2020 results, despite significant operating and economic challenges.

Fourth Quarter 2020

Fourth quarter revenues were $693.4 million, a decrease of 5%primarily due to lower volumes related to a service interruption at Lazaro Cardenas due to teachers’ protests, lower fuel surcharge and fluctuations in foreign currency.

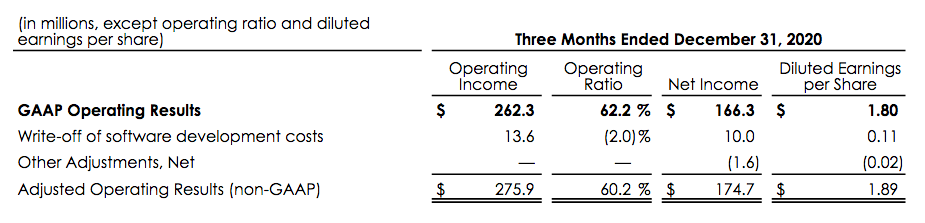

Fourth quarter operating expenses were $431.1 million. Operating income was $262.3 million and the reported operating ratio was 62.2%. Fourth quarter net income was $166.3 million, or $1.80 per diluted share. Adjusted fourth quarter operating income, operating ratio, net income and diluted earnings per share were as follows:

“Despite several significant challenges in the fourth quarter, including continued impacts from the pandemic, weather events and an extended outage from illegal protests on segments of our network in Mexico, KCS delivered strong fourth quarter results,” stated president and chief executive officer, Patrick J. Ottensmeyer. “Thanks to the hard work and dedication of our employees, we are overcoming the adversity that we faced in the fourth quarter and throughout 2020, and we heighten our focus on Precision Scheduled Railroading (PSR)-driven service improvements to realize the significant growth opportunities that we see going forward.”

Full Year 2020

Full year 2020 revenues were $2.6 billion, a decrease of 8% on a 6% decline in carloads. Operating income was $1.0 billion and the reported operating ratio was 61.9%. Full year 2020 net income was $619.1 million, or $6.54 per diluted share.

During 2020, the KCS network experienced a rapid decline in volumes followed by an unprecedented volume rebound, forcing the Company to quickly adjust its service model to match customer demand while optimizing its cost structure. These actions resulted in significant improvements to train length and fuel efficiency, improving 12%and 5%, respectively. PSR initiatives also contributed directly to operating expense savings of $96 million in 2020, and are projected to deliver incremental savings of $50 million in 2021.

“As we turn our focus to 2021, our primary objective will be the implementation of PSR Phase 3, which combines improved operational performance with an intense focus on customer service and revenue growth,” stated Ottensmeyer. “Phase 3 of PSR will help us capitalize on the unique growth opportunities available across our franchise.

“These growth opportunities, combined with an intense focus on excellent execution, give us confidence to reinstate a multi-year outlook, which has improved from the guidance provided a year ago. We look forward to delivering another year of strong returns to shareholders.”

For more detailed Q4 information, GAAP reconciliations, and analysis of full-year 2020 results, please visit the KCS website.

Links to other Class 1 Q4 2020 earnings results:

Union Pacific Q4 2020 and Full-Year 2020 results

CN reports Q4 2020 and Full-Year 2020 results

Canadian Pacific reports Q4 2020 and full-year 2020 results

Norfolk Southern reports Q4 2020 and full-year 2020 results