Pandemic challenged BNSF in 2020; railroad ‘in good hands’ for 2021

Written by Marybeth Luczak, Executive Editor, Railway Age

Despite a 7% decline in volume, BNSF’s profit margin increased by 2.9 percentage points in 2020, Warren Buffet, Chairman of the Board for parent company Berkshire Hathaway, told shareholders.

In the company’s recently released 2020 annual report, he credited BNSF CEO Carl Ice and “his number two,” Katie Farmer, for their “extraordinary job in controlling expenses while navigating a significant downturn in business.” (Farmer took over the top spot when Ice retired at year-end.)

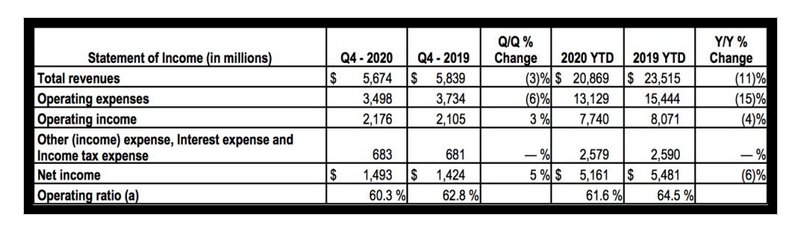

BNSF released its quarterly results March 1. Total revenues for the fourth quarter ($5.67 billion) and full-year 2020 ($20.87 billion) decreased 3% and 11%, respectively, vs. the same periods in 2019. According to the Class I railroad, the changes were primarily due to a 3% increase and 7% decrease in unit volume, respectively, in the corresponding periods. BNSF attributed the full-year volume decrease to the COVID-19 pandemic, which severely impacted the first half of 2020. However, volumes “sequentially improved from earlier periods and recovered overall to pre-pandemic levels by the end of the year,” it noted.

For full-year 2020, pre-tax earnings came in at $6.8 billion, a decrease of 6.3% from 2019, “principally due to the negative impacts of the pandemic on volumes,” according to the Berkshire Hathaway 2020 annual report.

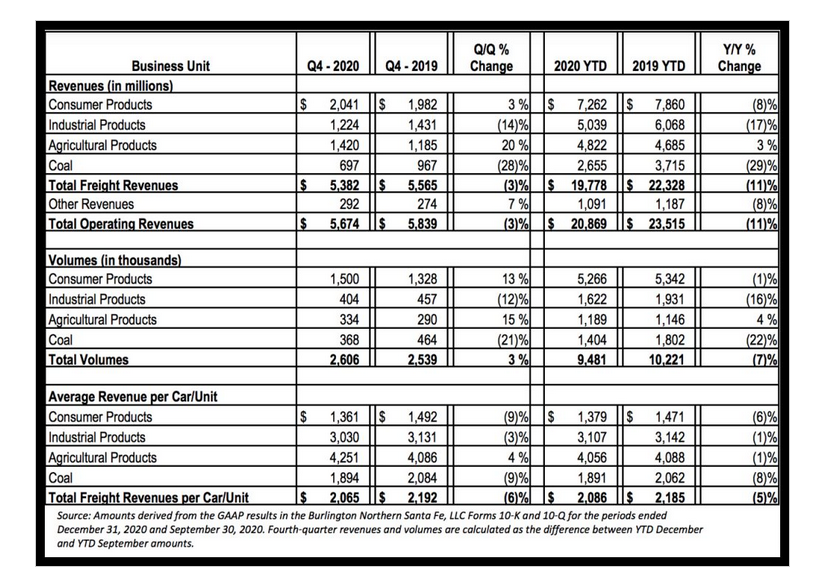

Here is the volume breakdown (and see chart below):

• Consumer products: While volumes were down 1% for the year, due to the pandemic, they rose 13% for the fourth quarter, according to the railroad. BNSF reported that “lower international intermodal and automotive volumes in the first three quarters were offset by higher domestic intermodal volumes”; increased retail sales, retailer inventory replenishments and e-commerce activity resulted in a second-half recovery of intermodal volumes, which led to increases in the fourth quarter compared with the 2019 period.

• Industrial products: Volumes decreased 12% and 16% for the fourth quarter and full year 2020, respectively, vs. the same periods in 2019. “These changes were primarily due to a decline in U.S. industrial production driven by the pandemic, including reduced production and demand in the energy sector, which drove lower sand and petroleum products volume, along with reduced steel demand, which drove lower taconite volume,” the railroad said.

• Agricultural products: Volumes for the fourth quarter and the full year rose 15% and 4%, respectively, compared with the same periods in 2019. BNSF attributed the full-year increase to, primarily, “higher grain and soybean meal exports, partially offset by the adverse impacts of the COVID-19 pandemic on volumes, primarily for ethanol and sweeteners shipments. In Q4, grain and meal exports continued to remain strong, while other volumes recovered from the impacts of the pandemic, leading to the increase in the quarter from the prior year.”

• Coal: Volumes for the fourth quarter and full year decreased 21% and 22%, respectively, vs. the same 2019 periods—primarily a result of “lower natural gas prices, lower electricity demand driven by the COVID-19 pandemic, utility coal plant retirements and mild temperatures.”

BNSF Financials

Operating income for the fourth quarter ($2.2 billion) and full-year 2020 ($7.7 billion) saw an increase of $71 million (3%) and a decrease of $331 million (4%), respectively, vs. the same points in 2019.

Operating ratio came in at 60.3% for the fourth quarter and 61.6% for the full year—improving 2.5% and 2.9%, respectively, compared with the same periods in 2019.

Operating expenses for the fourth quarter ($3.498 billion) and the full year ($13.129 billion) declined 6% and 15%, respectively, vs. the same 2019 periods. BNSF attributed the decrease to “volume-related changes, lower fuel prices, productivity improvements, and the effects of cost control initiatives. The full year benefitted from lower costs related to improved weather conditions compared to 2019.” (Severe winter weather and flooding on parts of the network impacted the railroad in 2019.)

BNSF’s 2020 capital improvements totaled $3.08 billion, “the largest component of which supported maintenance and expansion of its network to operate a safe, reliable and efficient network that meets customer demands,” the railroad reported. For 2021, CAPEX is set at $2.99 billion. (Railway Age reported on the investment breakdown Jan. 20.)

Looking ahead, Berkshire Hathaway noted in its 2020 annual report that the pandemic continues to evolve, and “the full extent to which it may impact BNSF’s business, operating results, financial condition, or liquidity will depend on future developments. We believe BNSF’s fundamental business remains strong and it has ample liquidity to continue business operations during this volatile period.”

Buffet summed up in his shareholder letter: “Your railroad is in good hands.”