CPKC Merger Approved – Updated March 17

Written by William C. Vantuono, Editor-In-Chief, Railway Age

As widely expected, the Surface Transportation Board has approved, with certain conditions, Canadian Pacific’s acquisition of Kansas City Southern to form Canadian Pacific Kansas City, North America’s first transnational railroad.

The Board approved the merger, first proposed on March 21, 2021, by a 4-1 vote. Member Robert Primus was the only dissenter. The decision authorizes CP to exercise control of KCS as early as April 14, 2023, a date that CP and KCS have now set to combine to create the new CPKC. CP also announced the CPKC executive leadership team.

CP completed its US$31 billion acquisition of KCS on Dec. 14, 2021. Immediately upon the closing of that acquisition, shares of KCS were placed into a voting trust with Dave Starling, former KCS President and CEO, appointed as the trustee. Upon Starling’s death, Ronald L. Batory was appointed as successor trustee with the STB’s approval. The Voting Trust “has ensured that KCS operates independently of CP during the regulatory review process, and until CP exercises control pursuant to the STB decision, CP and KCS will continue to operate independently,” CP noted.

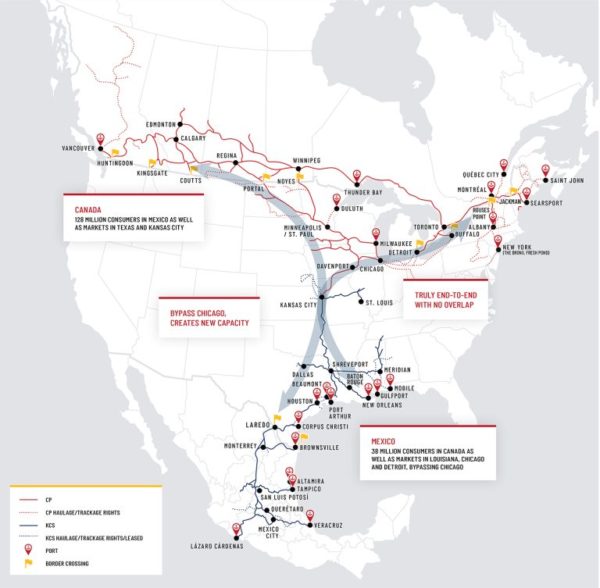

Headquartered in Calgary, Alta., Canada, CPKC would remain the smallest of six U.S. Class I railroads by revenue, and have a much larger and more competitive network, operating approximately 20,000 miles of rail, employing close to 20,000 people. Once combined, full integration of CP and KCS is expected to happen over the next three years, “unlocking the benefits of the combination.”

STB SUMMARY

“The Board expects that this new single-line service will foster the growth of rail traffic, shifting approximately 64,000 truckloads annually from North America’s roads to rail, and will support investment in infrastructure, service, quality, and safety. The transaction is also expected to drive employment growth across the CPKC system, adding more than 800 new union represented operating positions in the United States,” STB said in its 212-page decision. “Of additional importance, The merger will foster new Amtrak passenger rail opportunities, as applicants have committed to support Amtrak’s existing plans for expanded service on the new railroads lines. These commitments, along with CP’s strong record as an Amtrak host railroad, have won Amtrak’s endorsement of the merger.The merger will foster new Amtrak passenger rail opportunities, as applicants have committed to support Amtrak’s existing plans for expanded service on the new railroads lines. These commitments, along with CP‘s strong record as an Amtrak host railroad, have one Amtrak’s endorsement of the merger.

“This transaction is ‘end-to-end,’ meaning that there are little to no track redundancies or overlapping routes. If consummated, it will reduce travel time for traffic moving over the single line service; that should result in increased incentives for investment; and it will eliminate the need for the two now-separate CP and KCS systems to interchange traffic moving from one system to the other. This will enhance efficiency, which in turn will enable the new CPKC system to better compete for traffic with the other larger class one carriers. It is not surprising that there is substantial (though not unanimous) shipper support for this transaction — the Board has received more than 450 support letters. It is also not surprising that the other Class I railroads seek conditions, and other remedies that appear aimed at protecting their own traffic from competition with CPKC and at limiting the ability of the combined CPKC to meet its potential. Consistent with the Board’s policy to protect competition and not competitors, the Board is denying those requests while also ensuring that existing competitive gateway options are preserved.

“Even end-to-end mergers, however, can pose competitive risks, and indeed this decision overturns prior agency precedent that did not sufficiently recognize such concerns. To address any potential anti-competitive harm, the Board is imposing numerous conditions design to protect competition. And with these conditions, the merger should not reduce any shipper’s competitive options. The Board establishes a detailed obligation to keep gateways — that is, connection points between the CPKC system and other railroads – open on commercially reasonable terms, thereby preserving efficient routing options via other railroads that were available to shippers before the merger.

“To help enforce that obligation, the Board will require CPKC to justify in writing, upon customer request, rate increases over a certain level on interline movements, subject to the gateway obligation. If disputes arise over whether CPKC’s actions are commercially reasonable, CPKC must afford rail customers an arbitration option to resolve disputes, but the Board also will remain available to expeditiously decide gateway-related disputes. In this way, this decision seeks to enable a more efficient and competitive CPKC system, while minimizing CPKC’s ability to wield new market power to the detriment of its shippers.

“In addition, the Board has engaged in an extensive and thorough environmental review, culminating with the issuance of the Final Environmental Impact Statement — totaling more than 5,000 pages with appendices — on January 27, 2023, The findings of which are adopted in this decision. The Board has also approved important measures designed to mitigate potential environmental impacts of the transaction, such as increased noise.”

“The Board recognizes that, although most localities would prefer less rather than more train traffic, any traffic that CPKC diverts from trucks and from other railroads will produce more trains traversing areas that are currently served by either CP or KCS. This transaction, however, should ultimately enhance safety and benefit the environment. First, rail transportation is overall safer and better for the environment than transportation by truck. And second, increases in rail traffic in one neighborhood resulting from diversion from another railroad would be offset, at least in part, by a reduction in rail traffic in the neighborhood from which it is diverted. In any event, the thorough environmental review in this proceeding has confirmed that many parties that expressed concerns live in communities that already have substantial train traffic. For example, only eight additional trains per day are expected in the Chicago area, the busiest rail terminal in the nation, which already hosts approximately 1,300 freight, commuter, and Amtrak trains per day.

“Although the Federal Railroad Administration (FRA), rather than the Board, is the principal regulator of rail safety, the Board, consistent with the Rail Transportation Policy (RTP), does consider safety in its merger decisions. Here, having considered the Final EIS and the Safety Integration Plan (SIP) Applicants will be following, the Board concludes that this merger will not increase safety risks in any meaningful way beyond whatever level of risk exists from the current daily moves of trains through the communities served by CP and KCS. Indeed, approval of this transaction may even enhance safety for the nation as a whole. In addition to the inherent safety advantages that will be gained from shifting approximately 64,000 truckloads from our roads to rail, CP has the best safety record of the Class I railroads over the Past 15 years, and KCS will adopt many of CP’s practices following integration. Thus, any rail traffic diverted to CPKC from other railroads will likely mean traffic moving to a railroad with a better safety record.

“To ensure that the expected public benefits from this merger are realized to the fullest extent possible, the Board is establishing an unprecedented seven-year oversight period along with extensive data-reporting requirements. This will enable the Board to closely monitor whether Applicants are in fact preserving efficient interline options for shippers at affected gateways, thus protecting competition. The Board also will be able to issue additional orders later, if necessary, to enforce the required environmental mitigation measures and address capacity and maintain fluidity in Houston, Tex., Chicago, and other congested areas, including preventing potential merger-caused delays and service disruptions of commuter service in the Chicago area.

“The Board recognizes that some in the shipping community and among antitrust commentators are not satisfied with the consolidation among Class I railroads that occurred following the Staggers Rail Act of 1980, and the Board itself has done its best to address how the Class I railroads behave today. Indeed, there is an ongoing debate about whether there has already been too much consolidation in the rail industry. Regardless of which side one takes in that debate, the Board is charged by Congress with reviewing the proposed merger in light of the state of the industry as it actually exists. Given the current realities and the limited opportunities to provide meaningful competition for the largest Class I railroads, as outlined above and discussed at length in this decision, the Board concludes that this transaction should improve rather than degrade the performance of the industry. It is for these reasons that the Board approves the merger.”

CP President and Chief Executive Officer Keith Creel, Railway Age’s 2021 Railroader of the Year and, with Kansas City Southern President and CEO Pat Ottensmeyer, 2022 Co-Railroader of the Year, “extended the company’s sincere gratitude to the STB board and staff for their hard work as part of the comprehensive review of the combination.”

“This decision clearly recognizes the many benefits of this historic combination,” Creel said. “As the STB found, it will stimulate new competition, create jobs, lead to new investment in our rail network, and drive economic growth. These benefits are unparalleled for our employees, rail customers, communities and the North American economy at a time when the supply chains of these three great nations have never needed it more. A combined CPKC will connect North America through a unique rail network able to enhance competition, provide improved reliable rail service, take trucks off public roads and improve rail safety by expanding CP’s industry-leading safety practices.”

“This important milestone is the catalyst for realizing the benefits of a North American railroad for all of our stakeholders,” said Ottensmeyer. “The KCS Board of Directors and management team are very proud of the many contributions and achievements of the people who have made KCS what it is today and we are excited for the boundless possibilities as we move forward into the next chapter as CPKC.”

CPKC “will bring a new standard of safety to the North American rail landscape,” CPsaid. “CP has been the safest railroad in North America for 17 straight years as measured by the Federal Railroad Administration train accident frequency ratio. In 2022, CP had an all-time best frequency of 0.93, a rate nearly half what the company produced a decade ago and 69% lower than the Class I average. CP’s culture of safety, supported by its history of sustained investments in core infrastructure and technology, aligns with KCS’s likeminded culture, allowing the combined system to operate at the apex of rail safety. CPKC will implement the combination with safety at the forefront of everything it does.”

TD COWEN INSIGHT

“The combination of a single-line railroad spanning Canada, U.S., and Mexico should result in a gradual but notable shift from West Coast ports, igniting more cross-border business coming from the Port of Lázaro Cárdenas,” observes TD Cowen Managing Director, Industrials – Airfreight and Surface Transportation and Railway Age Wall Street Contributing Editor Jason Seidl. “We see Union Pacific standing to lose the most share among the U.S. Class I‘s. Comments made by the STB Chairman suggest further regulatory oversight for US operations.

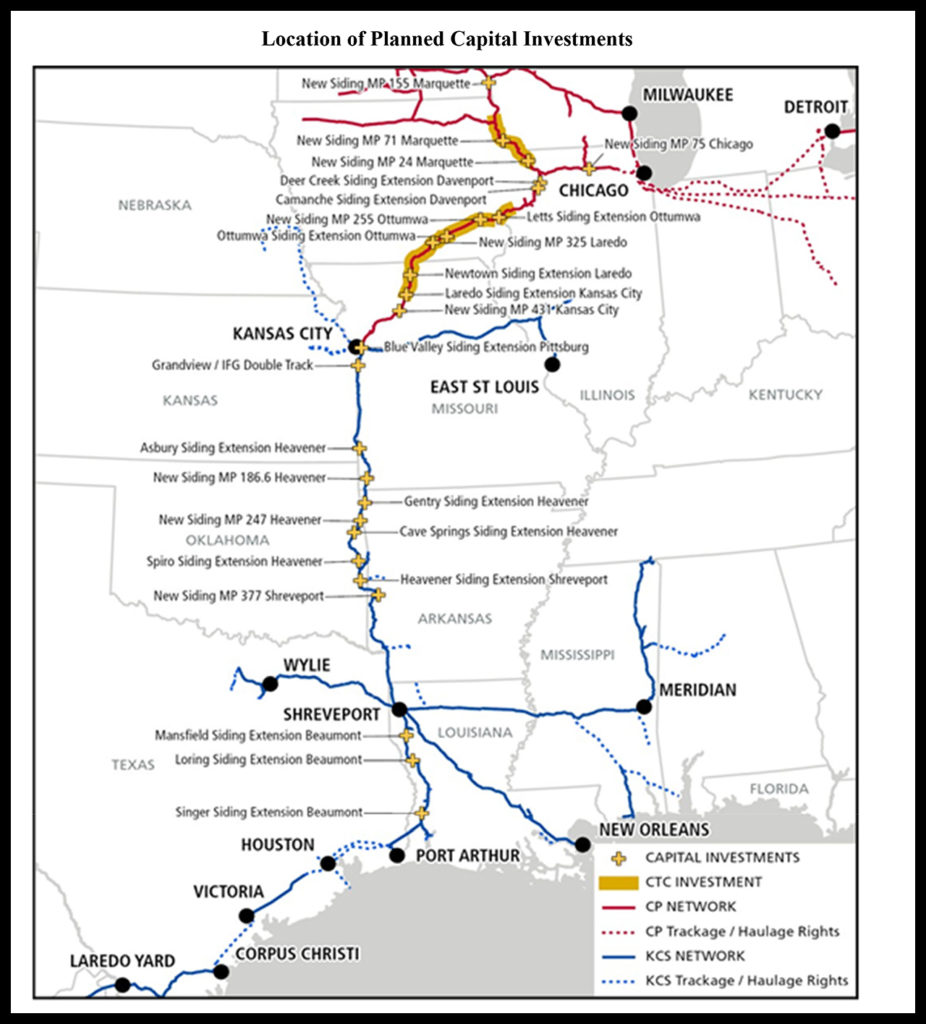

“The combined network will comprise ~20,350 miles of track across the continent and is expected to result in more than $275 million in incremental capital expenditures while adding 800 new union jobs to the industry. All other Class I remedies were rejected by the STB. This was somewhat surprising to us and may be why the U.S. rails were underperforming the broader market on March 15.

“The transaction is expected to ‘alleviate supply chain pressures at the ports of Los Angeles and Long Beach.’ The newly combined railroad should support growth from the Port of Lázaro Cárdenas, which has developed an efficient rail service container facility that has available capacity. The Port of Lazaro handled ~1.7 million TEUs in 2021, up 59% y/y. While the Board noted that most of the congestion has been alleviated, it is not to say that ‘those ports could not become congested again.’ Public benefits were also cited for U.S. rail shippers from the availability of new single-line routes from the Port of Lázaro Cárdenas, particularly when Western U.S. ports are congested. We believe this is a potential negative for Western carriers UP and BNSF, which may see a gradual but notable shift away from West Coast ports, especially during times of supply chain congestion.

“UP has the most cross border connections to Mexico and opposed the transaction. As of last year, UP had between 60%-70% of cross-border traffic, which is at risk of new competition—a bullish point from the STB’s point of view to increase competition. The STB expects the single-line service will shift ~64,000 truckloads annually in North America to rail from truck, which would [eliminate] 127,000 tons of carbon dioxide every year. This opportunity may spur investor interest on the ESG side, where carbon reductions will be evident as intermodal adoption continues.”

Amtrak Bullish on CPKC

“Amtrak congratulates Canadian Pacific and Kansas City Southern on their newly approved merger,“ said CEO Stephen Gardner. “We believe this merger will have a significant and positive effect on Amtrak intercity passenger rail service. CP has committed to support Amtrak efforts to work with the Southern Rail Commission, States, and other stakeholders for the first passenger trains in more than 50 years on two U.S. routes, establishing Amtrak service between New Orleans and Baton Rouge, La., and studying the potential for Amtrak service between Meridian, Miss., and Dallas/Fort Worth on the new CPKC. The Board’s decision fulfills the objectives of President Biden’s Executive Order on Promoting Competition in the American Economy, which called upon the Board to consider impacts on Amtrak service when reviewing proposed railroad mergers. CP has been a strong partner with Amtrak and the States in working collaboratively to enhance Amtrak service.“

Tags: Breaking News